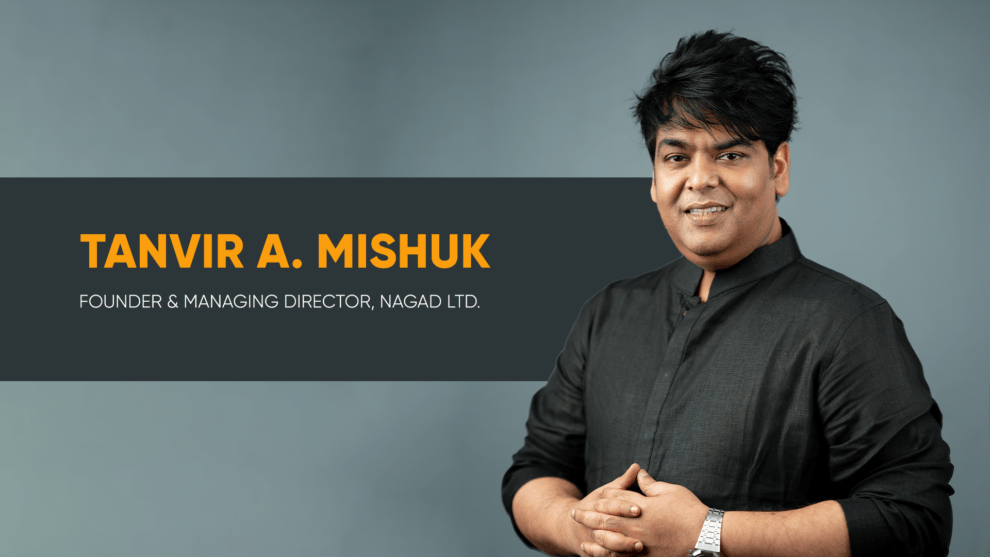

1. Share some insights into your childhood and early influences that shaped your entrepreneurial spirit and leadership style?

I embarked on my educational journey in a Bangla medium public school & college and later earned a BBA degree from North South University. With the aspiration of pursuing an MBA, I enrolled at Dhaka University. However, I encountered some challenges that ultimately prevented me from continuing my studies at that level.

My professional journey began in the technology and telecom sector, with my career taking off in Singapore. In Bangladesh, I founded a leading IGW (International Gateway) company that played a pivotal role in meeting approximately 70% of the country’s telecommunications needs. However, around 2017, with the emergence of messaging platforms, such as WhatsApp, Viber, and IMO, the telecom market began to experience a downturn. Recognizing the changing market dynamics, I decided to pivot my career toward financial technology.

I’ve ventured into various other businesses as well, with Nagad being my 13th entrepreneurial endeavor. The idea for Nagad began to take shape in 2017, and with the invaluable support of Prime Minister Sheikh Hasina, Nagad officially launched its journey in 2019. This venture stands as a significant milestone in my entrepreneurial journey, and I am committed to contributing to the financial technology landscape in Bangladesh.

2. Share the story behind the initiation of Nagad and the motive behind starting this venture.

When I first made the decision to foray into the fintech sector, I faced significant skepticism from both board members and market analysts. Their concerns were valid, given the history of approximately 35 banks that had previously failed in the Mobile Financial Services (MFS) sector. Moreover, the market was dominated by a single entity, holding a staggering 99% market share, leaving just 1% to be shared among other players. This monopoly, bolstered by partnerships with major companies, appeared insurmountable. Despite these discouraging odds, I made the deliberate choice to embrace the challenge.

At that time, MFS primarily revolved around domestic remittances, facilitating the transfer of money between cities, such as Dhaka, Chattogram, and Sylhet. However, I envisioned a more purposeful role for MFS – one that could redefine the way financial services were delivered. We set out to create products that would allow individuals to experience fintech in its truest form, consolidating all their financial needs within a single app.

3. In the rapidly evolving field of Mobile Financial Services (MFS) and Digital Financial Services (DFS), how do you ensure a seamless service and experience?

Our approach was marked by innovations at every turn, introducing products that the people of Bangladesh had never seen before. In stark contrast to the traditional two-page forms that took 7-10 days to open an account, we digitized the process. Now, all it takes is a single selfie and a photo of one’s National ID, and our AI-based verification system swiftly opens an MFS account. This transformative approach has led to the rapid growth of our customer base, which now stands at a staggering 8.5 crore.

Our innovations were not only groundbreaking but also designed with the utmost ease and convenience in mind. This commitment to making financial services accessible and user-friendly has propelled Nagad to its current position of prominence. It serves as a testament to our dedication to redefining financial services in Bangladesh and providing the population with a seamless and innovative banking experience.

4. Nagad has gained widespread acceptance among the masses in a relatively short period. Could you elaborate on the key factors that have contributed to this rapid growth and acceptance?

The key to Nagad’s success lies in its commitment to addressing the real and pressing needs of the Bangladeshi people through innovative products. Unlike some companies that innovate merely for show-off or self-promotion, our focus is squarely on meeting the needs of the common people.

We have introduced groundbreaking products that the people of Bangladesh have long been waiting for. For instance, we pioneered the digitalization of KYC (Know Your Customer) processes, streamlining and simplifying this essential procedure. Moreover, we’ve removed unnecessary barriers, ensuring that anyone can send money through Nagad, whether they have a Nagad account or not.

Our dedication to innovation doesn’t stop here. We have an array of innovative products in the pipeline, which we are excited to introduce to the public soon. These innovations are designed to further enhance the financial well-being and convenience of the people of Bangladesh.

Nagad’s success can be attributed to its commitment to addressing real needs and providing innovative solutions that make a tangible difference in people’s lives. Our innovative products are the secret recipe behind our continued success and the trust placed in us by the Bangladeshi community.

5. What strategies and initiatives has Nagad implemented to sustain its growth as well as grow financial awareness among users?

Nagad has been proactive in promoting financial literacy through various awareness programs. However, we recognize the importance of making our products so user-friendly that people don’t need extensive training to use them. Our aim is to align our technology with the familiar tools and platforms that people already use daily, such as YouTube, Facebook, or IMO. This approach minimizes the learning curve and ensures accessibility for a wider audience.

In addition to creating user-friendly technology, we are committed to proceeding with ongoing awareness programs with a view to educating our users about best practices, thus protecting them from fraud. These programs emphasize the importance of safeguarding sensitive information, such as PINs and OTPs.

In a country with a population of 170 million, attaining financial literacy cannot be solely attributed to one company or accomplished overnight. It necessitates a collaborative effort involving not just Nagad, but also the government, other MFS providers, and banks, which will work together to educate and empower the population. Through this united front, we can collectively elevate financial literacy levels and foster responsible financial behavior across the nation.

6. How is Nagad contributing to changing the digital landscape in Bangladesh, and what role do you see Nagad playing in realizing the “Smart Bangladesh 2041” vision?

I firmly believe that the first step towards creating a “Smart Bangladesh” is the introduction of a Digital Bank. I believe we can achieve this milestone in due time. It’s important to note that this achievement is not solely to our credit; the government has played a significant role in this endeavor. Their proactive measures, including policy formulation and the efficient evaluation of 52 companies within just one month, demonstrate their commitment to progress.

In this vision of a “Smart Bangladesh,” the cornerstone will be the Digital Bank, where individuals will have the entire bank at their fingertips through a single mobile app. This innovative approach will empower people to address all their financial and banking needs conveniently and efficiently. It represents a crucial initial step in Nagad’s journey towards contributing to the realization of a truly Digital Bangladesh.

7. What steps or initiatives is Nagad taking to promote and ensure financial security in the growing world of Digital financial services?

During our five-year journey, we’ve gained invaluable experience in understanding how fraud can negatively impact people’s financial well-being. Through extensive research and development efforts, we’ve strived to create a digital banking system that prioritizes security, aiming to minimize common forms of fraud, such as unauthorized access using PINs or OTPs.

Our commitment to security is unwavering, and we have implemented stringent measures to enhance the safety of digital banking transactions. Our goal is to reduce fraud incidents by a substantial 80%.

By adopting advanced security protocols, stringent authentication processes, and continuous monitoring, we aspire to provide our users with peace of mind when conducting financial transactions in the digital realm. As we move forward, safeguarding your financial assets and information remains our top priority.

8. Digital banking is a growing trend globally. How is Nagad planning to leverage this trend and become a changemaker in the field of digital banking in Bangladesh?

Since 2020, I’ve been advocating for the concept of a digital bank in Bangladesh, even in the face of skepticism. Now, in 2023, we see significant progress with the Bangladesh Bank having digital bank guidelines, attracting interest from 52 companies and approximately 500 entrepreneurs. This development underscores the importance of digital banking in our country’s future.

A digital bank holds the potential to tackle several issues that traditional banks and MFS providers often cannot address. For instance, securing a loan from a traditional bank typically entails extensive paperwork, and formalities, and can pose a psychological barrier, especially for individuals who may feel uncomfortable in such formal settings.

Consider a small poultry farmer who may not have the confidence to visit a bank in a lungi. Digital banking can break down these barriers by offering a simplified, user-friendly interface that allows people to apply for loans with just a few clicks. Furthermore, by eliminating the need for collateral, we can empower those who lack substantial assets to access affordable loans, often saving them from the predatory practices of moneylenders who charge exorbitant interest rates, sometimes as high as 40%.

Another critical issue that digital banking can address is the lack of savings options accessible to ordinary people in Bangladesh. MFS providers typically offer limited savings options at low interest rates, and traditional banks often require a significant initial deposit, making it difficult for people with modest incomes to save.

Our vision with digital banking is to provide an opportunity for individuals to save even small amounts, as low as BDT 10, without cumbersome requirements. This way, we aim to encourage a culture of savings and help channel a significant portion of Bangladesh’s informal economy into the formal sector.

Our goal is to transition Bangladesh’s 52% informal economy into the formal economy, and we firmly believe that Digital Banking is the key to achieving this. With the right approach, we cannot only offer access to affordable loans but also promote financial inclusion and savings for all, contributing to the overall economic growth and prosperity of our country.

9. What opportunities do you see in the digital economy and cashless transactions in Bangladesh, and how is Nagad positioned to capitalize on these opportunities?

Transitioning to a cashless economy or a digital economy is indeed a complex process that cannot happen overnight. The government has made significant strides by initially digitizing the entire country, making the internet widely accessible, and connecting Bangladesh to the global digital landscape. This foundational work has set the stage for a digital transformation.

The challenge lies in bringing the 52% of funds currently within the informal economy into the formal financial system. When these funds become part of the formal economy, they have the potential to significantly stimulate economic growth. The government’s swift action in establishing digital banks is a testament to their forward-thinking approach.

However, achieving a fully cashless economy in Bangladesh will take time, perhaps around five years, and it will require robust government support. Breaking the habit of using physical cash, which is deeply ingrained in society, necessitates a concerted effort.

For example, during the COVID-19 pandemic, the government made the COVID test payment option available exclusively through Nagad. This prompted a large number of underbanked people to open Nagad accounts and make payments digitally. If the government continues to offer its services exclusively through cashless transactions, it can gradually encourage people to adopt digital payment methods.

The government’s proactive steps and digital infrastructure development are paving the way for a cashless Bangladesh. However, achieving this goal will require time, persistence, and a systematic approach to change people’s cash-centric habits while continuing to provide essential services through digital means.

10. Beyond the Smart Bangladesh Vision 2041, could you share your personal entrepreneurial vision and the goals you aspire to achieve in the near future?

Since 2020, I’ve been advocating for Nagad’s transformation into a Digital Bank by 2023. If all goes as planned, we’ll witness Nagad’s transition to a Digital Bank in 2023. My primary goal is to bring the 52% of funds currently within the informal economy into the formal economy, thereby bolstering our country’s economic development.

Additionally, I’m committed to eradicating the plight of common people who are burdened by exorbitant interest rates when seeking loans from moneylenders, often at rates as high as 30% to 40%. These loans are taken for various purposes such as starting businesses, financing weddings, pursuing education, or even migrating abroad. This financial burden is especially crippling for these individuals, and my aim is to completely alleviate their suffering within the next three years.

In Dhaka, it’s relatively easy to secure loans from banks, but the common populace continues to fall victim to the predatory practices of loan sharks. To address this issue, we must create a system that offers affordable and accessible loans, ensuring that people don’t have to resort to high-interest loans for their financial needs.

Furthermore, we must redirect the savings of our citizens back into our economy. Currently, a significant portion of these savings remains outside the formal economy. Our objective is to facilitate the smooth transition of these funds into the formal sector. By doing so, we aim to reduce our dependence on the garment sector and tap into the vast reservoir of financial resources within our country. This shift has the potential to significantly bolster our overall economic growth.